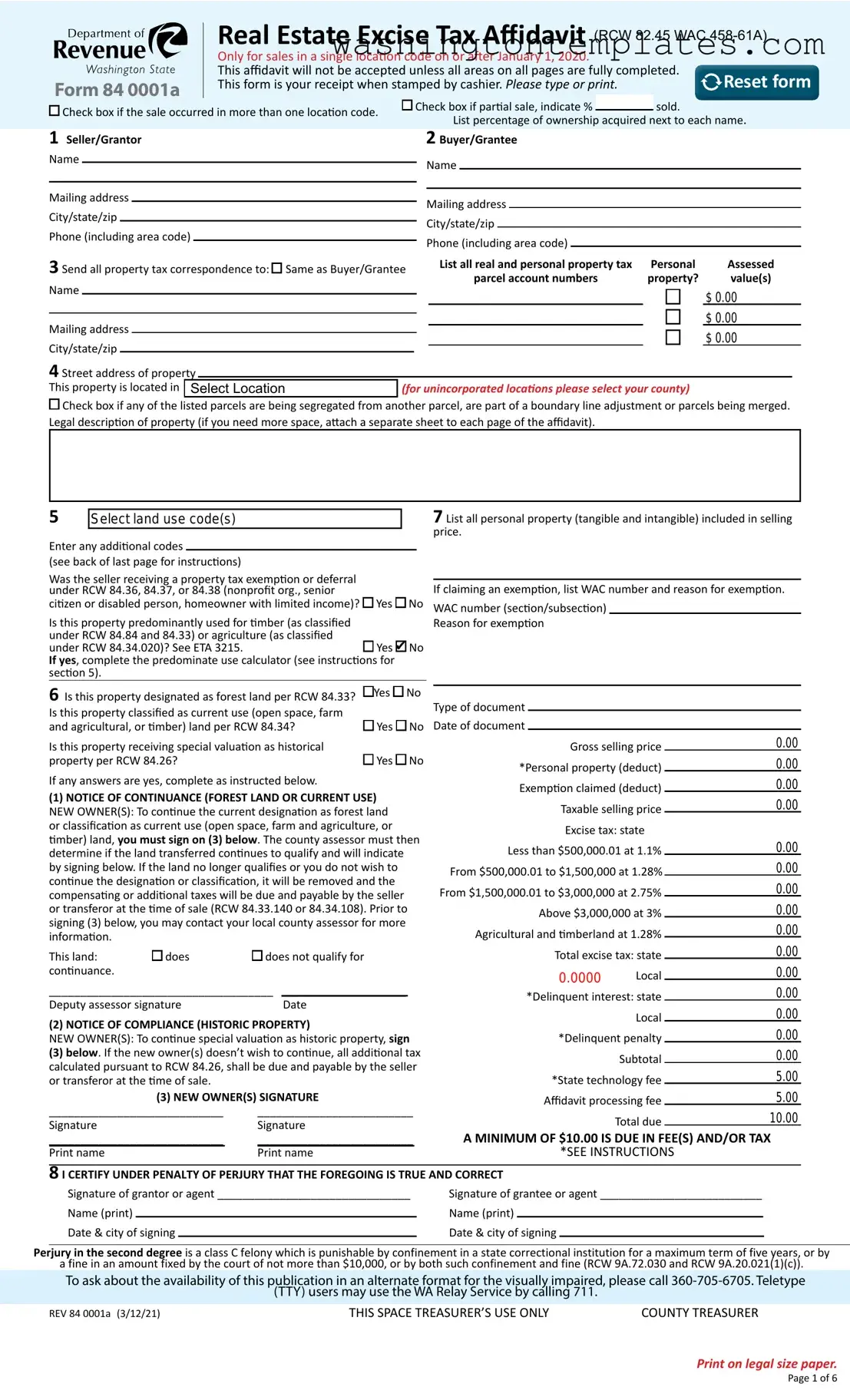

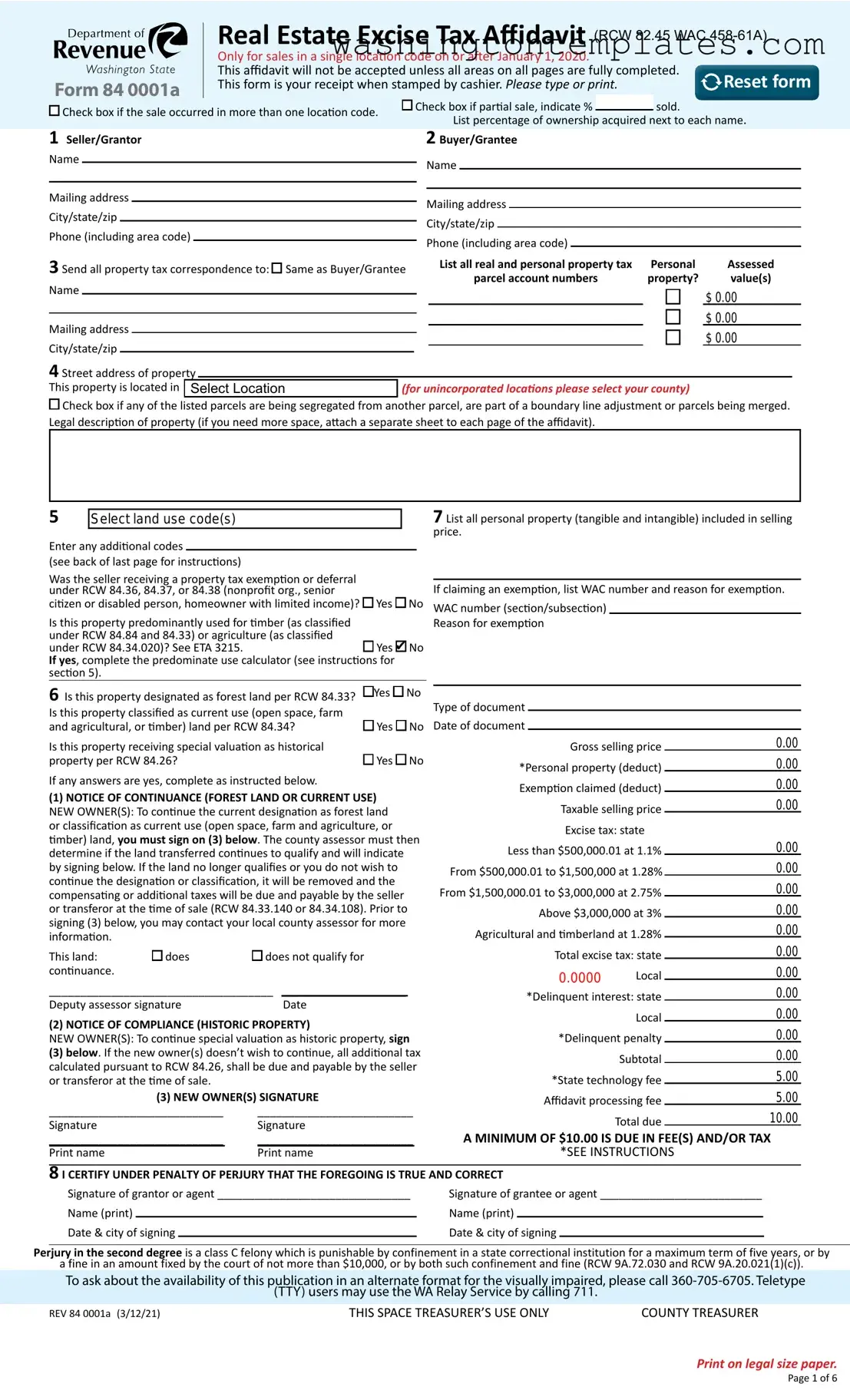

Instructions

Note: To report a transfer of a controlling interest in real property, please use the Real Estate Excise Tax Affidavit Controlling Interest Transfer Return, Revenue Form No. 84-0001B. This form is available online at dor.wa.gov.

Section 1:

If the sale involves property in more than one location code, use the Multiple Location Real Estate Excise Tax Affidavit. If sale is less than 100%, check the box “Check if partial sale” and bill in the percentage sold.

Enter the name(s) of seller/grantor exactly as listed on the legal conveyance document including the method of holding title.

Section 2:

Enter the name(s) of buyer/grantee exactly as listed on the legal conveyance document including the method of holding title. List the percentage acquired after each name.

Sect on 3:

•Enter the name and address where you would like all future property tax information sent.

•Enter the tax parcel number and current assessed value for real and personal property being conveyed in this county. Check the box to indicate personal property.

Section 4:

•Enter the street address of the property.

•Enter the county if in unincorporated area. Enter city name if located within a municipality.

•Enter the legal description of the property.

Section 5:

Enter the appropriate land use code for the property. Please list all codes that apply on the lines provided in section 5. See WAC 458-53-030(5) for a complete list.

|

9 - Land with mobile home |

26 |

- Paper and allied products |

64 |

- Repair services |

|

10 |

- Land with new building |

27 |

- Printing and publishing |

65 |

- Professional services |

|

11 |

- Household, single family |

28 |

- Chemicals |

(medical, dental, etc.) |

|

units |

29 |

- Petroleum refining and related |

71 |

- Cultural activities/nature |

|

12 |

- Multiple family residence |

industries |

exhibitions |

|

(2-4 Units) |

30 |

- Rubber and miscellaneous |

74 |

- Recreational activities |

|

13 |

- Multiple family residence (5+ |

plastic products |

(golf courses, etc.) |

|

Units) |

31 |

- Leather and leather products |

75 |

- Resorts and group camps |

|

14 |

- Residential condominiums |

32 |

- Stone, clay and glass products |

80 |

- Water or mineral right |

|

15 |

- Mobile home parks or courts |

33 |

- Primary metal industries |

81 |

- Agriculture (not in current use) |

|

16 |

- Hotels/motels |

34 |

- Fabricated metal products |

83 |

- Agriculture current use |

|

17 |

- Institutional Lodging |

35 |

- Professional scientific |

RCW 84.34 |

|

(convalescent homes, nursing |

and controlling instruments; |

86 |

- Marijuana grow operations |

|

homes, etc.) |

photographic and optical goods; |

87 |

- Sale of Standing Timber |

|

18 |

- All other residential not |

watches/clocks manufacturing |

88 |

- Forest land designated |

|

coded |

39 |

- Miscellaneous manufacturing |

RCW 84.33 |

|

19 |

- Vacation and cabin |

50 |

- Condominiums-other than |

91 |

- Undeveloped Land (land only) |

|

21 |

- Food and kindred products |

residential |

94 |

- Open space land RCW 84.34 |

|

22 |

- Textile mill products |

53 |

- Retail Trade - general |

95 |

- Timberland classified |

|

23 |

- Apparel and other finished |

merchandise 54 - Retail Trade - food |

RCW 84.34 |

|

products made from fabrics, |

58 |

- Retail trade - eating & drinking |

96 |

- Improvements on leased land |

|

leather, and similar materials |

(restaurants, bars) |

|

|

|

|

24 |

- Lumber and wood products |

59 |

- Tenant occupied, commercial |

|

|

|

(except furniture) |

properties |

|

|

|

25 |

- Furniture and fixtures |

|

|

|

|

•Check yes if the seller was receiving a property tax exemption or deferral under RCW 84.36, 84.37, or 84.38 (nonprofit organization, senior citizen, or disabled person, homeowner with limited income).

•Check yes if the land is primarily used for timber as defined by RCW 84.34 and 84.33 or agriculture as defined by RCW 84.34.020. See ETA 3215 for additional information. If the sale involves multiple parcels with different land use codes, complete the predominate use worksheet.

Section 6:

Indicate whether the property is designated as forest land per chapter 84.33 RCW, classified as current use (open space, farm, agricultural, or timber) per chapter 84.34 RCW, or receiving special valuation as historic property per chapter 84.26 RCW.

Section 7:

•List personal property included in the selling price of the real property. For example, include tangible (furniture, equipment, etc.) and intangible (goodwill, agreement not to compete, etc.).

•Use Tax is due on personal property purchased without payment of the sales tax. Report use tax on your Combined Excise

•Tax Return or a Consumer Use Tax Return, both available at dor.wa.gov.

•If you are claiming a tax exemption, cite the specific Washington Administrative Code (WAC) number, section and subsection and provide a brief explanation. Most tax exemptions require specific documentation. Refer to the appropriate WAC to determine documentation requirements. WAC 458-61A is available online at dor.wa.gov.

•Enter the type of document (quit claim deed, statutory warranty deed, etc.), and date of document (MM/DD/YYYY).

•Enter the selling price of the property.

•Selling price: For tax purposes, the selling price is the true and fair value of the property conveyed. When property is conveyed in an arm’s length transaction between unrelated persons for valuable consideration, there is a presumption that the selling price is equal to the total consideration paid or contracted to be paid, including any indebtedness. Refer to RCW 82.45.030 for more information about selling price.

Print form

Print form