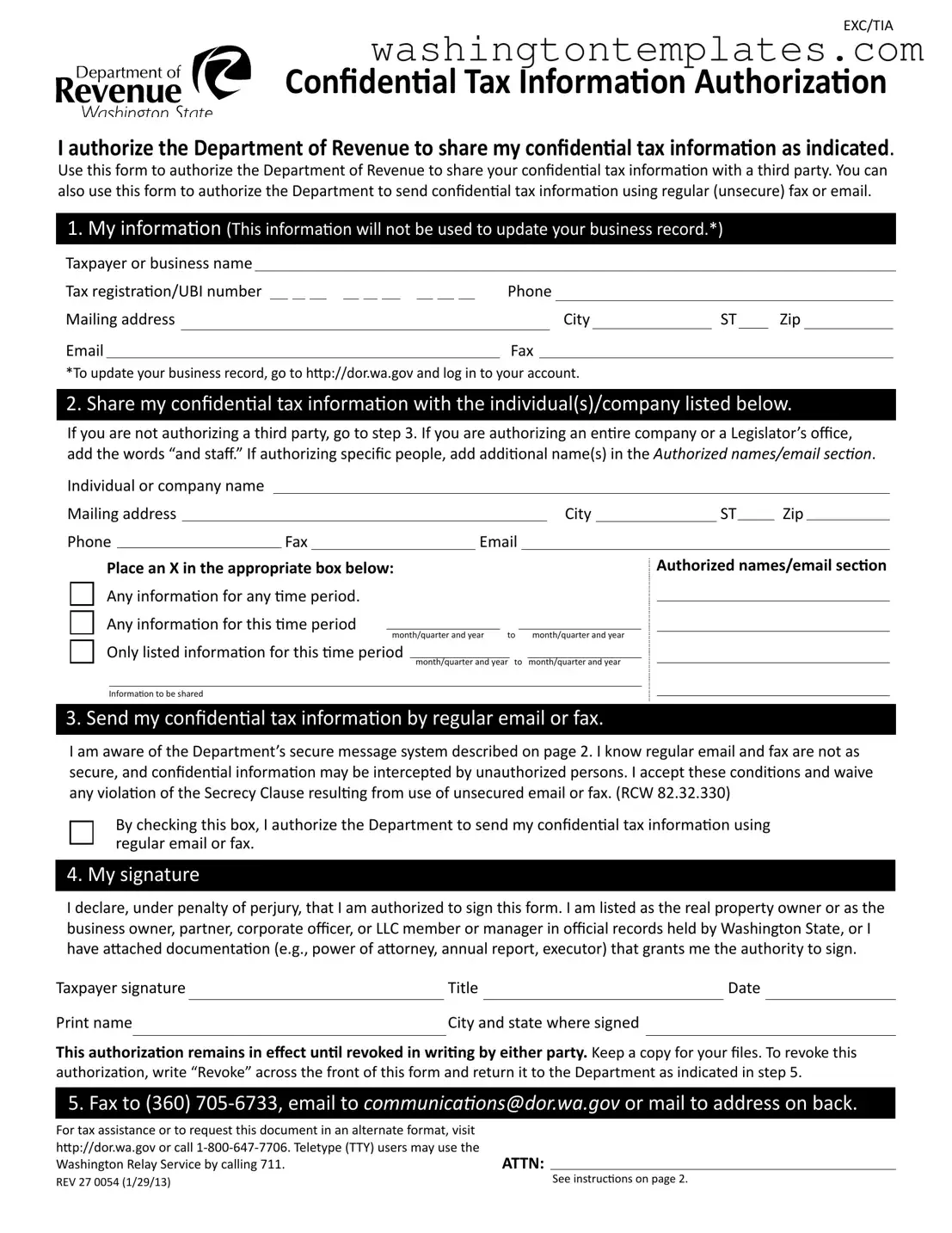

EXC/TIA

Conidenial Tax Informaion Authorizaion

I authorize the Department of Revenue to share my conidenial tax informaion as indicated.

Use this form to authorize the Department of Revenue to share your conidenial tax informaion with a third party. You can also use this form to authorize the Department to send conidenial tax informaion using regular (unsecure) fax or email.

1.My informaion (This informaion will not be used to update your business record.*)

Taxpayer or business name

Tax registraion/UBI number Mailing address

Email

Phone

Phone

Fax

*To update your business record, go to htp://dor.wa.gov and log in to your account.

2. Share my conidenial tax informaion with the individual(s)/company listed below.

If you are not authorizing a third party, go to step 3. If you are authorizing an enire company or a Legislator’s oice, add the words “and staf.” If authorizing speciic people, add addiional name(s) in the Authorized names/email secion.

Individual or company name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

ST |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

Fax |

|

Email |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place an X in the appropriate box below: |

|

|

|

|

|

|

|

|

|

Authorized names/email secion |

|

|

Any informaion for any ime period. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Any informaion for this ime period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

month/quarter and year |

|

|

month/quarter and year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only listed informaion for this ime period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

month/quarter and year |

|

month/quarter and year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Informaion to be shared

3. Send my conidenial tax informaion by regular email or fax.

I am aware of the Department’s secure message system described on page 2. I know regular email and fax are not as secure, and conidenial informaion may be intercepted by unauthorized persons. I accept these condiions and waive any violaion of the Secrecy Clause resuling from use of unsecured email or fax. (RCW 82.32.330)

By checking this box, I authorize the Department to send my conidenial tax informaion using

regular email or fax.

4. My signature

I declare, under penalty of perjury, that I am authorized to sign this form. I am listed as the real property owner or as the business owner, partner, corporate oicer, or LLC member or manager in oicial records held by Washington State, or I have atached documentaion (e.g., power of atorney, annual report, executor) that grants me the authority to sign.

Taxpayer signature |

|

Title |

Date |

|

|

|

|

|

Print name |

|

City and state where signed |

|

This authorizaion remains in efect unil revoked in wriing by either party. Keep a copy for your iles. To revoke this authorizaion, write “Revoke” across the front of this form and return it to the Department as indicated in step 5.

5. Fax to (360) 705-6733, email to communicaions@dor.wa.gov or mail to address on back.

For tax assistance or to request this document in an alternate format, visit |

|

htp://dor.wa.gov or call 1-800-647-7706. Teletype (TTY) users may use the |

|

Washington Relay Service by calling 711. |

ATTN: |

REV 27 0054 (1/29/13) |

See instrucions on page 2. |

|

Authorizaion for Conidenial Tax Informaion

Page 2

Conidenial tax informaion

Tax informaion is conidenial and cannot be shared with anyone without express permission. By compleing this form, you are authorizing the Department to share your conidenial tax informaion with the person(s) you name. This request may cover all conidenial tax informaion or it may be limited to certain informaion and/or periods of ime. In secion 2, please describe the speciic informaion you want the Department to share and the periods covered by this authorizaion.

Secure messaging

Secure messaging is ofered through the Department’s online My account secion. Taxpayers that have an online account can access secure messaging when logged in. Click on Email & noices in the let menu, then click on Secure email.

Taxpayers that don’t have an online account can register at dor.wa.gov. To create an account, provide your name, email, and phone number; create a logon ID and password; then choose a security quesion.

If you want to add your business to your online account, enter your UBI/Tax registraion number and your Pre-assigned Access Code (PAC). Your PAC can be found on the upper right corner of the leter you received from the Department when you irst opened your business. It is also on mailed tax returns and at the botom of balance due noices.

Only people authorized to access your online account can see secure messages.

ATTN: (If you are working with a Revenue employee)

If you are working with a Revenue employee, write the employee’s name on the ATTN: line on the botom of page 1 of

this form and RETURN THE FORM AS INSTRUCTED.

Otherwise, send this form to:

Fax (360) 705-6733

Email communicaions@dor.wa.gov

Mail Dept. of Revenue

Taxpayer Services

PO Box 47478

Olympia, WA 98504-7478

Quesions? Call the Department at 800-647-7706.

Washington State Department of Revenue |

Phone: 800-647-7706 |

PO Box 47478 |

Fax: (360) 705-6733 |

Olympia, Washington 98504-7478 |

htp://dor.wa.gov |

Phone

Phone