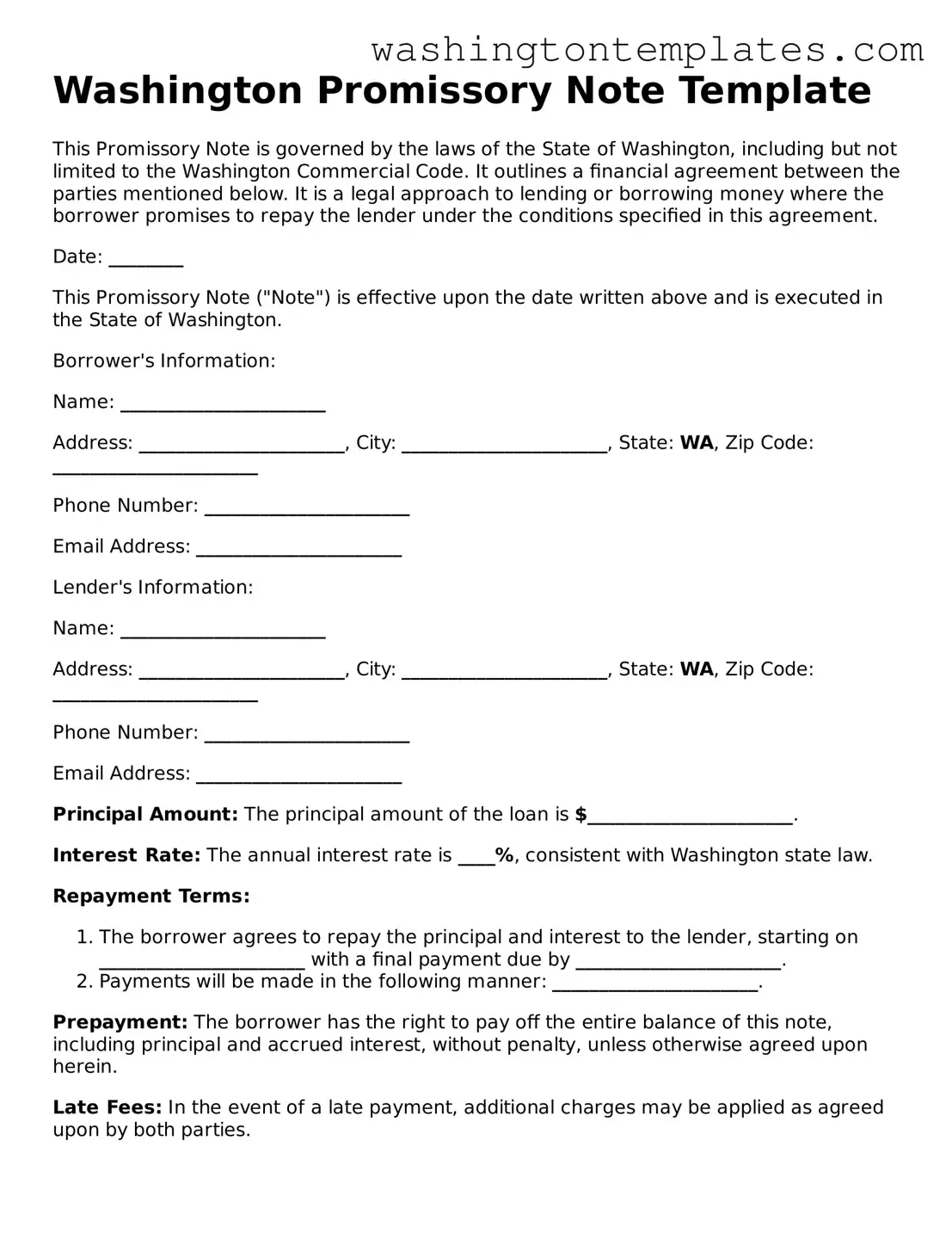

Washington Promissory Note Template

This Promissory Note is governed by the laws of the State of Washington, including but not limited to the Washington Commercial Code. It outlines a financial agreement between the parties mentioned below. It is a legal approach to lending or borrowing money where the borrower promises to repay the lender under the conditions specified in this agreement.

Date: ________

This Promissory Note ("Note") is effective upon the date written above and is executed in the State of Washington.

Borrower's Information:

Name: ______________________

Address: ______________________, City: ______________________, State: WA, Zip Code: ______________________

Phone Number: ______________________

Email Address: ______________________

Lender's Information:

Name: ______________________

Address: ______________________, City: ______________________, State: WA, Zip Code: ______________________

Phone Number: ______________________

Email Address: ______________________

Principal Amount: The principal amount of the loan is $______________________.

Interest Rate: The annual interest rate is ____%, consistent with Washington state law.

Repayment Terms:

- The borrower agrees to repay the principal and interest to the lender, starting on ______________________ with a final payment due by ______________________.

- Payments will be made in the following manner: ______________________.

Prepayment: The borrower has the right to pay off the entire balance of this note, including principal and accrued interest, without penalty, unless otherwise agreed upon herein.

Late Fees: In the event of a late payment, additional charges may be applied as agreed upon by both parties.

Default: Failure by the borrower to meet the payment obligations as described in this note may result in a default, allowing the lender to demand immediate full repayment of the remaining balance, including principal and accrued interest.

Governing Law: This Note will be governed by and construed in accordance with the laws of the State of Washington, without giving effect to any principles of conflicts of law.

By signing below, both the lender and the borrower agree to the terms and conditions of this Promissory Note.

Borrower's Signature: ______________________, Date: ______________________

Lender's Signature: ______________________, Date: ______________________